Investors Could Be Concerned With Allegiant Travel’s (NASDAQ:ALGT) Returns On Capital

Investors Might Worry About Allegiant Travel’s (NASDAQ:ALGT) Capital Returns

What signs should we watch for in a stock that could grow significantly in the long term? Firstly, it’s essential to spot an increasing return on capital employed (ROCE) and a growing base of capital employed. This signifies that the company can continuously reinvest its profits back into the business to generate higher returns. However, when we initially look at Allegiant Travel (NASDAQ: ALGT), we don’t see significant upward trends in returns, prompting us to delve deeper.

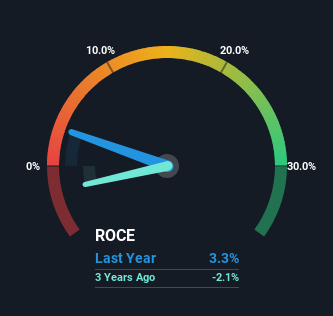

ROCE is a measure of a company’s annual pre-tax profit relative to the capital employed in the business. For Allegiant Travel, the ROCE calculation is as follows: Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets – Current Liabilities). Allegiant Travel’s ROCE stands at 3.3%, which is lower than the Airlines industry average of 8.4%.

Looking at the trend of ROCE at Allegiant Travel, it appears unconvincing. The returns on capital were 12% around five years ago, but they have since declined to 3.3%. The company is investing more capital, but this hasn’t significantly impacted sales over the past 12 months, suggesting these are long-term investments that may take time to yield earnings.

In conclusion, Allegiant Travel is reinvesting in the business, but returns are decreasing. With the stock falling by 58% over the past five years, investors may not be optimistic about this trend improving. Considering these factors, Allegiant Travel doesn’t exhibit the characteristics of a long-term growth stock. Those interested in solid companies should explore a list of companies with strong balance sheets and high returns on equity.

[Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.]

[Source link]